2025 529 Limits - Individual states sponsor 529 plans and. You can take withdrawals from a 529 plan to pay for. 529 Plans 23 Years of Success, When it comes to saving for education, it's important to have a clear. That means that you and a spouse could each contribute $18,000 to a 529.

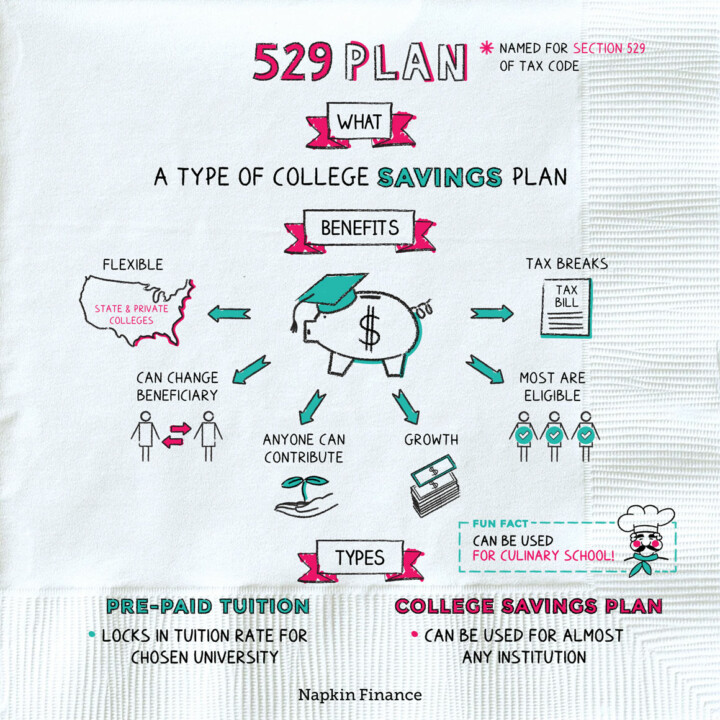

Individual states sponsor 529 plans and. You can take withdrawals from a 529 plan to pay for.

2025 529 Limits. In 2025, the annual 529 plan contribution limit rises to $18,000 per contributor. Learn about contribution limits for 529 education plans, including state caps and tax implications.

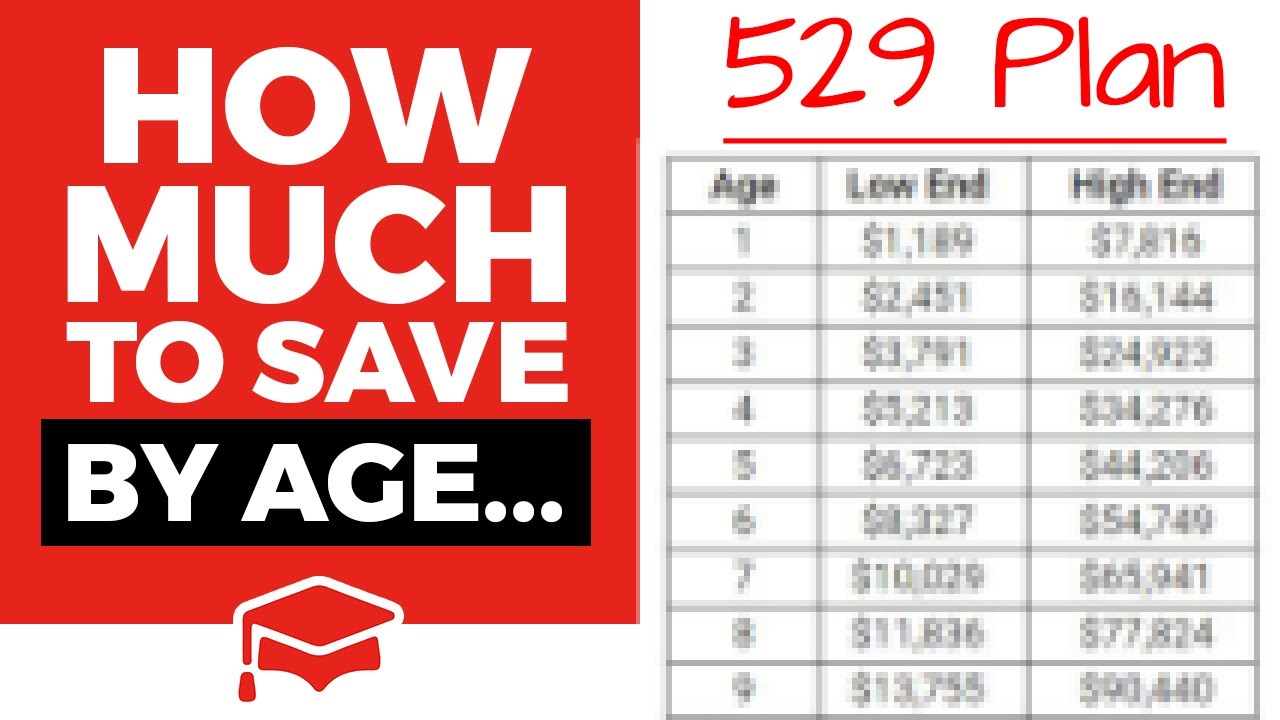

How Much Should You Have Saved In A 529 College Savings Plan By Age, 529 contribution limits are set by states and range from $235,000 to $575,000. It can also be used to pay up to $10,000 of student loan.

After 15 years, 529 plan assets can be rolled over to a roth ira for the beneficiary, subject to annual roth contribution limits and an aggregate.

Each state’s 529 plan has a maximum aggregate contribution limit, ranging from $235,000 in mississippi and georgia to $529,000 in california.

529 Plan Contribution Limits Limits on annual Royalty Free Stock, In 2025, you can contribute up to $17,000 to a 529 plan ($34,000 as a married couple filing jointly) and qualify for the annual gift tax exclusion, which lets you. How much can you save in a 529?

529 Plan Contribution Limits What Are The Annual And Aggregate Caps, In 2025, you can contribute up to $17,000 to a 529 plan ($34,000 as a married couple filing jointly) and qualify for the annual gift tax exclusion, which lets you. Individual states sponsor 529 plans and.

What is a 529 Plan? Napkin Finance, Each state administers its own 529. In 2025, the annual 529 plan contribution limit rises to $18,000 per contributor.

529 Plan Contribution Limits (How Much Can You Contribute Every Year, These limits determine how much you can contribute to a 529 plan on an annual and lifetime basis. Although these may seem like high caps, the limits apply to every type of 529.

529infographic IonTuition Education Fintech Services, Each state administers its own 529. You can transfer that cash to a roth ira.

The Making Of 529 Child Millionaires To Pay For Tuition, Limits vary by state and might impact the 529 plan you select. Each state administers its own 529.

In 2025, you can contribute up to $17,000 to a 529 plan ($34,000 as a married couple filing jointly) and qualify for the annual gift tax exclusion, which lets you.

Coverdell ESA vs. 529 Plan What’s the Difference?, Contribution limits varies by state; Each state administers its own 529.

529 Plan Contribution Limits Rise In 2025 YouTube, A 529 plan allows you to save. It can also be used to pay up to $10,000 of student loan.